how much does nc tax your paycheck

Tax Write-Offs You Dont Know About. These taxes are typically withheld from severance payments.

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina income is taxed at a constant rate of 525.

. North Carolina state tax on sales and use starts with a base rate of 475 percent with each county adding a local rate of between 2 and 275 percent. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. North Carolina has a flat income tax of 525.

All told the average North Carolinian is paying 2212 a year in income taxes. Detailed North Carolina state income tax rates and brackets are available on this page. Social Security income in North Carolina is not taxed.

Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax Motor Carrier Tax IFTAIN Privilege License Tax Motor Fuels Tax. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Any wages above 147000 are exempt from the Social Security Tax.

Use Before 2020 if you are not sure. North Carolina has not always had a flat income tax rate though. Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published.

Take Your 2019 Standard Deduction. A 2020 or later W4 is required for all new employees. As you can see North Carolina did not increase tax rate for 2021.

Do not include any social security benefits in gross income unless. Here you can find how your North Carolina based income is taxed at a flat rate. However withdrawals from retirement accounts are fully taxed.

How Much Does Nc Tax Your Paycheck. Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweek. North Carolina repealed its estate tax in 2013.

North Carolina Department of Revenue. The IRS recently added a new Withholding Calculator to their website and encourages all employees to use the calculator to perform a quick paycheck checkup. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator.

Subtract and match 145 of each employees taxable wages until they have earned 200000. Minimum Wage in North Carolina in 2021. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Learn North Carolina income tax property tax rates and sales tax to estimate how much youll pay on your 2021 tax return. Start filing your tax return now.

Experience rating is affected by payroll tax paid timeliness of payments and unemployment insurance benefits charged against the employers. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. North Carolinas UI tax rates are determined under an experience rating system.

North Carolina Gas Tax. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

North Carolina Sales Tax. North Carolina Income Tax Calculator 2021. Once an employer is eligible to receive a reduced tax rate the tax rate is determined annually based on experience.

A you are married filing a separate return and you lived with your spouse at any time in 2021. After a few seconds you will be provided with a full breakdown of the tax you are paying. PO Box 25000 Raleigh NC 27640-0640.

North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on.

North Carolina Estate Tax. Individual income tax refund inquiries. North Carolina Salary Paycheck Calculator.

Issuing comp time in place of overtime pay is not allowed for non-exempt employees. North Carolina Tax Brackets for Tax Year 2021. Gross income means all income you received in the form of money goods property and services that isnt exempt from tax including any income from sources outside North Carolina.

In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. For example for 2021 if youre single and making between 40126 and 85525 then you are responsible for paying 22 percent of your. Additionally pension incomes are fully taxed.

Switch to North Carolina hourly calculator. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind.

If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance.

How To Organize Tax Records Tax Organization Blog Organization Organization

Here S How Much Money You Take Home From A 75 000 Salary

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

Tax Information Career Training Usa Interexchange

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paperwork Needed For Buying A House Home Buying Buying First Home Buying Your First Home

2022 Federal State Payroll Tax Rates For Employers

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Solved Federal Taxes Not Deducted Correctly

How To Understand Your Paycheck Youtube Personal Financial Literacy Financial Literacy Understanding Yourself

Calculating Gross Pay Worksheet Student Loan Repayment Budgeting Worksheets Financial Literacy Worksheets

How To Take Taxes Out Of Your Employees Paychecks With Pictures

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

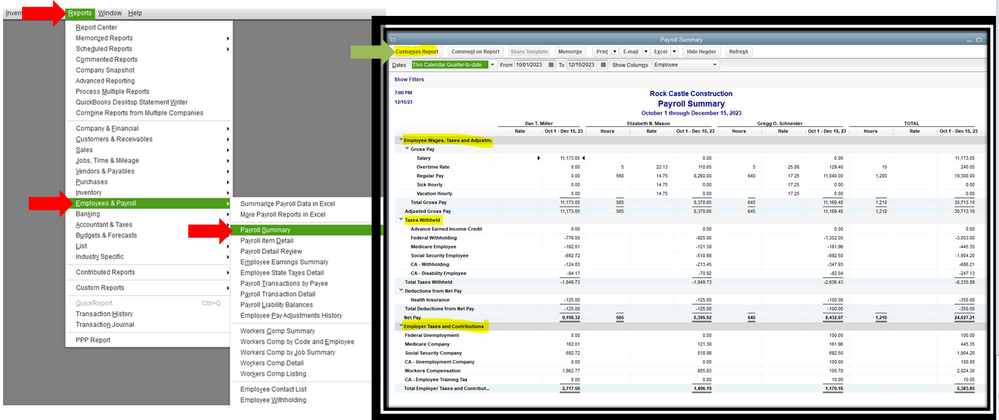

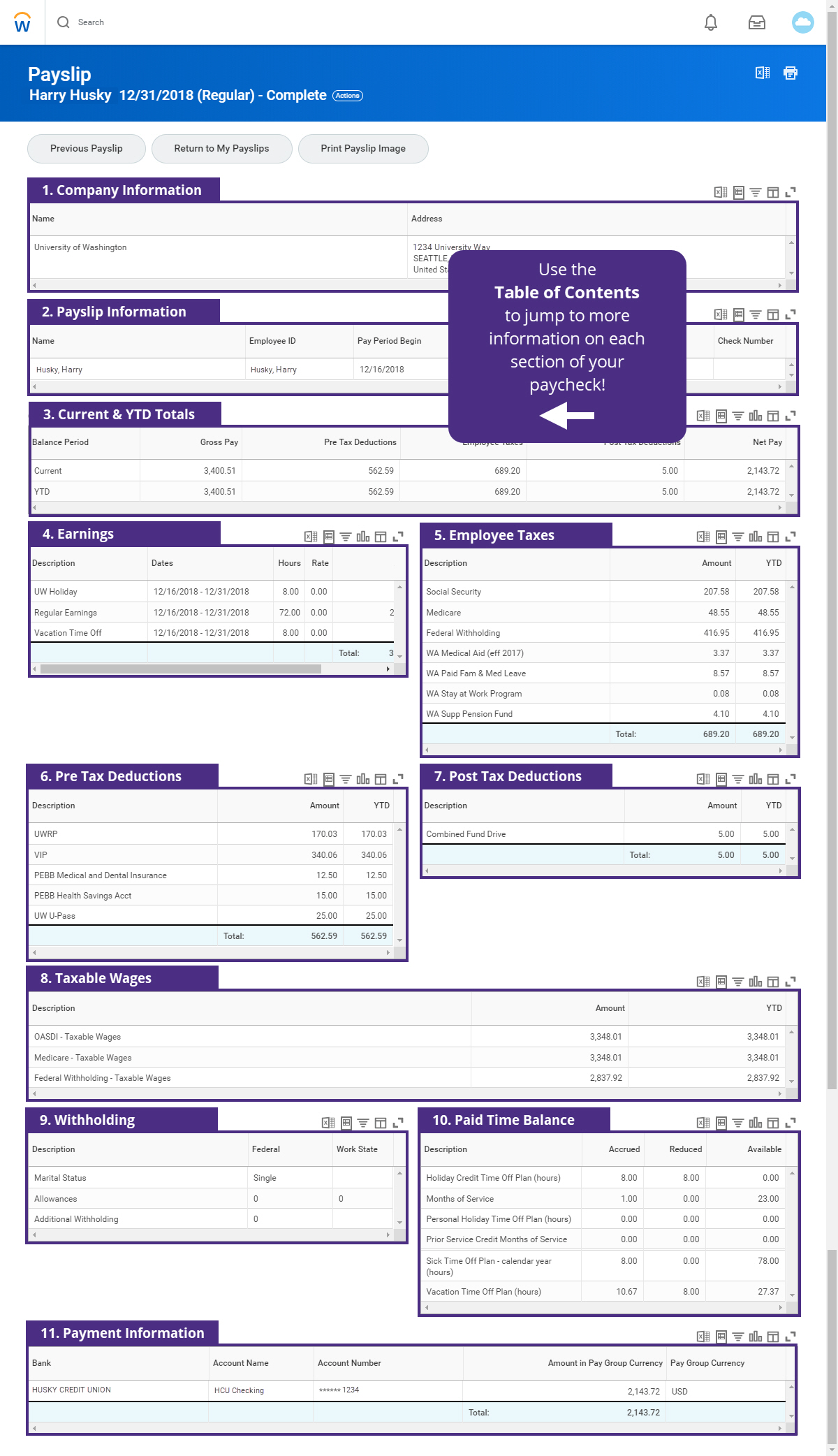

How To Read Your Payslip Integrated Service Center

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Paycheck